The Power of Automation: How iNymbus Transformed Deduction Management

The Power of Automation: How iNymbus Transformed Deduction Management

Dealing with deductions can be a real pain for businesses. Deductions are payment discrepancies that occur between businesses and their trading partner. It can happen due to various reasons such as damaged goods, billing errors, or a shortage of shipment.

These deductions can result in financial losses and reduced cash flows. Furthermore, managing deductions can be a challenging and time-consuming task, which can lead to delays in processing and a backlog of cases.

This is where iNymbus comes in – a chargeback management service provider that is transforming the way deductions are managed. It leverages the power of cloud-based robotic process automation (RPA) to streamline the entire claims processing workflow.

Deduction Management Challenge:

Managing deductions can be a tough and time-consuming task for businesses. The traditional way of managing deductions involves checking invoices, finding errors, and manually entering data into various systems. This manual process is inefficient and can lead to mistakes and delays.

Automated methods are faster and more accurate but can be expensive and require a lot of technological investments. Furthermore, automated methods may not always be able to handle complex or nuanced tasks that require human judgment and creativity. This can lead to errors or inaccuracies that may be difficult to catch and correct without human intervention.

How iNymbus Revolutionized Deduction Handling:

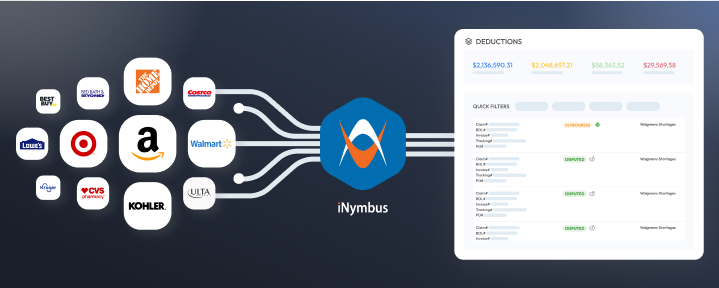

iNymbus is a company that has revolutionized the way deductions are handled by offering an end-to-end automation process. They use cloud-based robotic process automation to streamline deduction tracking, automate disputes, and provide valuable insights to businesses. The platform can extract deduction data, match it with invoices and documents, generate and submit disputes, and track the status of disputes.

What sets iNymbus apart from other chargeback management service providers in the market is their cost-effective and time-saving nature, allowing businesses to recover lost revenue, reduce errors, and navigate chargebacks with ease. It supports deductions from over 25 retailers, be it Walmart Chagebacks or Amazon Shortages, we can help you tackle them all.

iNymbus can also extract the deduction data, match it with invoices and documents, generate and submit disputes, and track the status of disputes. Additionally, the software has a comprehensive database of deduction codes and reasons for each retailer, making the dispute process more accurate and complete.

Success Stories:

The wireless accessories distributor and manufacturer faced significant challenges when dealing with big-box retailers such as Target and Best Buy. These retailers used complex chargeback and deduction systems that used independently operated customer portals, which made it challenging for the distributor to navigate across systems concurrently. The distributor was ill-equipped to manage such voluminous transactions, resulting in frustration and over-burdened A/R departments.

However, with the help of iNymbus- AR deduction management software, the wireless accessories distributor was able to process chargebacks and deductions more seamlessly, eliminating the tedious tasks associated with traditional portal systems from big-box retailers. By implementing iNymbus technology, employees were able to reallocate manpower to other initiatives more strategically, improving workplace efficiencies while increasing the number of man-hours available.

iNymbus resolved and disputed deductions and chargebacks using automated systems that increased workplace efficiencies by up to 30x, processing claims immediately by uploading and submitting documentation. With iNymbus, companies can dramatically reduce the amount of labor involved in handling chargeback claims and deductions.

The Future of Deduction Management:

Thanks to the advancements in technology and the emergence of automation platforms, the future of deduction management is looking brighter than ever before. With the help of cloud-based robotic process automation (RPA)automation tools like iNymbus, businesses can streamline the deduction management process, reduce errors, and recover lost revenue.

The integration of automation has allowed businesses to automate many routine tasks, such as data entry and deduction categorization, and has enabled them to easily identify which deductions are valid and which ones are not. This has significantly reduced the risk of errors and has saved businesses a considerable amount of time and money in the process.

Going forward, the trend towards automation is only set to grow, as businesses look for cost-effective and efficient ways to manage their deductions. In the future, we can expect to see more sophisticated AI-powered tools that can analyze data in real time, predict trends, and offer valuable insights to businesses.

Conclusion:

Managing deductions can be a tedious and expensive process for any business. The traditional manual approach is prone to errors and can lead to lost revenue. Fortunately, with cloud-based robotic process automation (RPA) tools such as iNymbus, businesses can now streamline their deduction management process, minimize errors, and recover lost revenue. With iNymbus, businesses can enjoy an efficient and cost-effective way of managing deductions, allowing them to focus on other aspects of their operations.